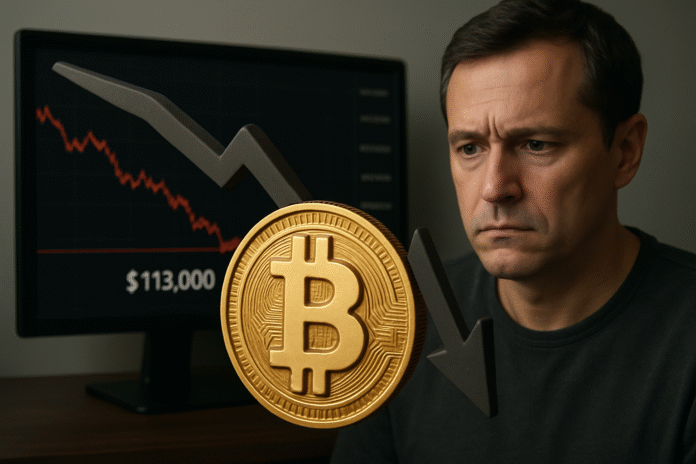

Takeaways

- Bitcoin dipped below $113,000 after weeks of downward pressure, thanks to economic worries, new regulations, and seasonal crypto slumps.

- Liquidations and nervous selling made the drop steeper, but for long-term holders, it’s nothing new.

- If you’re not sure what to do, you’re not alone—sometimes the best move is simply to wait for the storm to pass.

Welp, if you checked your crypto portfolio today hoping for a quiet weekend, you probably did a double take—Bitcoin just dipped under $113,000. For anyone new to this space, or even if you’re a grizzled veteran, it’s always a bit jarring to see those big red numbers. But what happened, and does this mean we should all panic? Let’s break it down in real-world terms.

The Short Version: Why the Dip?

Friday night into Saturday, Bitcoin breached that big psychological level—$113,000—hitting as low as $112,992 on Binance and several other major exchanges. That’s a pretty significant drop considering Bitcoin was knocking on the door of $123,000 not long ago. This isn’t just a random blip; it’s been building as part of a short-term downtrend over the last week or so.

What’s Causing It All?

It’s a bit of a storm, honestly. Three things seem to be stirring the pot the most:

- Macroeconomic Pressures: The U.S. Federal Reserve recently held off on interest rate cuts, keeping rates steady. That’s not great news for risky assets like crypto because it means investors are less likely to throw money at something as wild as Bitcoin and more likely to play it safe.

- Regulatory Uncertainty: There’s lots of buzz (and worry) about new crypto regulations coming out of the White House and SEC. Every time there’s talk of more oversight, you see some investors get cold feet and pull their money—a kind of “wait and see” approach.

- Seasonal Slump: August is a somewhat unusual month for Bitcoin historically, typically characterised by low trading volumes and significant price swings in both directions. This year seems to be following that script again.

On top of all that, a bunch of traders who made big bets on Bitcoin’s price going up got “liquidated” (meaning they had to sell their coins to cover losses), which pushed prices down even more—crypto dominoes falling.

What Does This Mean for Regular Folks?

For your average person, this might just feel like another scary dip. If you’re new to crypto, seeing thousands wiped off the price in a day can feel like the end of the world. But folks who’ve been around the block know this is kind of how it goes—crypto winters, big dips, then recoveries. If you’re in for the long haul, these drops are almost background noise.

It’s not all doom and gloom: a lot of people see these drops as buying opportunities, kind of like stocks going on sale. Some big-time traders are circling, looking to scoop up some cheap coins in case Bitcoin bounces back soon. But if you’re already holding it, it can be pretty nerve-wracking—imagine checking your weather app and seeing, “Chance of storms—bring an umbrella and maybe some antacids.”

Final Thoughts

Times like these—when Bitcoin takes a significant dip—tend to separate the tourists from the true believers. If you’re feeling nervous, maybe don’t watch the price every hour. Take a break. Play some Mario Kart. The crypto rollercoaster isn’t for the faint of heart, but history shows the ride keeps going even after the bumps.